What Is Income Protection Insurance in NZ? 2025 Guide for Kiwis

Income protection insurance in NZ is more than a backup plan — it’s your financial safety net when life takes an unexpected turn.

Imagine this:

You wake up one morning with a serious illness or injury. Suddenly, your income stops.

But your bills?

They don’t care.

✅ Your mortgage payment is still due. The power bill hasn’t gone away. Groceries, insurance, school fees, car payments — none of them wait for you to get better.

They keep coming, whether you can work or not.

For thousands of Kiwis each year, this isn’t just a worst-case scenario — it’s real life. From cancer treatment to mental health burnout or injury, many New Zealanders are forced off work for months (sometimes years), with little to fall back on.

And here’s the kicker:

ACC only covers accidents. WINZ pays just a few hundred dollars a week — if you even qualify.

That’s why income protection insurance exists.

It replaces up to 75% of your income if you’re medically unable to work due to illness or injury. Think of it as a paycheque that shows up when you can’t.

💬 “Not sure where to start? 👉 Compare income protection policies now to see what suits your income, lifestyle, and health situation.”

In This Article, You’ll Learn:

✅ What income protection covers (and what it doesn’t)

✅ Why it’s different from ACC, trauma, or life cover

✅ How to figure out how much cover you actually need

✅ What it costs in NZ — with real examples

✅ How to choose the right plan for 2025

What Is Income Protection Insurance?

📚 A Simple Definition

Income protection insurance in NZ is a type of personal insurance that pays you a regular monthly income if you’re unable to work due to illness, injury, or accident, and a medical professional has certified that inability.

Unlike trauma insurance (which gives you a one-time lump sum for critical illnesses), income protection is like a replacement salary that continues to arrive while you’re recovering.

It’s your safety net when sick leave runs out and ACC doesn’t apply.

💡 How Does It Work?

Here’s what you need to know about how income protection operates in New Zealand:

● ✅ Monthly Payouts: Typically up to 75% of your pre-tax income

● ✅ Taxable: These payments are usually taxed like normal salary, but since your expenses often drop when you’re not commuting or dining out, the real impact may be manageable.

● ✅ Benefit Duration: Payments continue until you:

○ Return to work

○ Reach the maximum benefit period (e.g., 2 or 5 years)

○ Reach retirement age (if you have an age 65 policy)

🧠 Why It’s Different From Other Insurance

| Type | Pays Out When… | How It Pays |

| Income Protection | You’re medically unfit to work (illness/injury) | Monthly income, ongoing |

| Trauma Insurance | You’re diagnosed with a specific critical illness | One-off lump sum |

| ACC (NZ) | You’re injured (not ill) | Partial income replacement (limited) |

✅ Income protection fills the gap left by ACC and WINZ, especially for long-term illnesses or health conditions. Compare the best providers on the Income Protection website.

🔎 Key Terms to Know

- Agreed Value: You lock in the payout amount when you buy the policy. Even if your income drops before claim time, your benefit doesn’t.

- Indemnity Value: Your benefit is based on your actual income at claim time. If your income recently declined (e.g., parental leave or job change), your payout may be lower.

💬 Pro Tip: If your income varies, like many self-employed Kiwis, consider choosing an agreed value for more certainty.

Read our article and calculate exactly how much cover you need.

How Income Protection Works in New Zealand

Income protection might sound complex, but in reality, it follows a straightforward process. Here’s a step-by-step look at how it works when you can’t work.

🔄 Step-by-Step Breakdown

🔹 Step 1: You Get Sick or Injured and Can’t Work

You’re medically declared unfit for work due to illness or injury. This could be a serious diagnosis, like cancer, burnout from stress, or a knee injury that requires surgery and time off.

🔹 Step 2: You Lodge a Claim with Your Insurer

You or your adviser submits a claim to your insurer. You’ll need medical evidence (e.g., a GP certificate) and proof of recent income, such as payslips or bank statements.

🔹 Step 3: You Serve a Waiting Period

This is your stand-down period, typically lasting 30 to 90 days from the last day you worked. Think of it like an insurance excess. You don’t get paid during this time, so you need savings to cover the gap.

🔹 Step 4: You Begin Receiving Monthly Payments

Once approved, your insurer begins paying a monthly benefit (up to 75% of your income) directly to your bank account or, if you’re under a group policy, to your employer.

🔹 Step 5: Payments Stop When One of These Happens:

● You return to work

● You reach your maximum benefit period (e.g., 2 years, 5 years, or age 65)

● You no longer meet the medical definition of “disabled”.

📦 Real Kiwi Example: Meet Matt

Matt, 42, is a self-employed builder in Rotorua. After a fall from a scaffolding, he tore his rotator cuff and couldn’t work for 6 months.

ACC covered his accident-related treatment but not his lost income beyond the limited payout.

Luckily, Matt had an income protection policy with a 30-day wait and a 2-year benefit period. After the wait, he received $3,750 per month for 5 months, which helped cover his mortgage, groceries, and family expenses while he recovered.

💡 “Now that you understand how it works, take the next step and find the best plan for you.”

✅ Important Note for Kiwis

ACC only covers accidents, not illness.

If Matt had been off work due to something like cancer or a heart condition, ACC wouldn’t have paid a cent. This is why private income protection fills a crucial gap.

🧠 Industry Insight

🧾 Around 70% of income loss claims in NZ come from illness, not injury.

That’s why relying on ACC or emergency savings alone leaves most Kiwis exposed.

Who Needs Income Protection Insurance in NZ?

If you rely on your income to meet financial commitments — from rent to raising kids — then income protection isn’t a luxury. It’s a lifeline.

In New Zealand, thousands of working Kiwis would be unable to meet their financial obligations if they lost their income for even a few months. Income protection ensures you don’t have to burn through savings, sell assets, or depend on WINZ to stay afloat.

👥 Who Needs It Most?

| Profile | Why It Matters |

| Mortgage Holders | Keep paying your home loan without falling behind or risking foreclosure |

| Parents | Maintain your family’s lifestyle, school fees, and household stability |

| Self-Employed Workers | No employer sick leave, no redundancy pay — you’re fully on your own |

| Skilled Professionals | If your role relies on mental or physical performance (e.g. surgeons, pilots) |

| Pre-Retirees (45–60) | Your peak earning years matter — safeguard your retirement timeline |

✅ Real Case Study: Meet Laura

Laura, a 45-year-old architect in Auckland, was diagnosed with breast cancer.

She faced 6 months of chemotherapy and ongoing fatigue that made working impossible.

Thanks to her income protection policy, Laura received $4,200 per month for 18 months — enough to cover her mortgage, support her two children, and take time to fully recover.

“It wasn’t just about money. It gave me time to heal without fear,” she says.

🧠 Pro Tip: If you’re

● Paying off a mortgage or business loan

● A sole income earner

● Running your own business

…then income protection should be one of your top financial priorities.

Even a temporary setback could lead to permanent damage without proper cover.

What Does Income Protection Insurance Cover in NZ?

Income protection insurance is designed to replace your income if you’re medically unable to work due to illness or injury. It’s not just about dramatic accidents — in fact, most claims in New Zealand relate to illnesses and mental health, not physical trauma.

✅ Common Conditions Covered

| Conditional Type | Examples |

| Physical Injuries | Fractures, back injuries, ligament tears, and serious sprains |

| Major Illnesses | Cancer, stroke, heart disease, MS, diabetes-related complications |

| Mental Health Issues | Clinical depression, anxiety disorders, PTSD |

| Surgical Recovery | Hip/knee replacement, organ surgery, spinal surgery, extended hospital stays |

These are typically covered as long as the condition prevents you from working in your current role and your GP or specialist certifies your condition.

💬 Example:

A software developer with carpal tunnel syndrome that requires surgery and weeks of rest may be eligible for a claim, even though the condition isn’t life-threatening, it impacts their ability to perform duties.

❌ What Income Protection Doesn’t Cover

Income protection does not cover every scenario. Here’s what’s typically excluded:

| Not Covered | Explanation |

| Redundancy | Unless added as a specific add-on or bundled product |

| Pre-existing Undisclosed Conditions | If not declared in your application, they can void your cover |

| Pregnancy-Related Leave | Unless complications arise (e.g., medically necessary bed rest) |

| Voluntary Time Off | Taking time off for burnout, sabbatical, or travel isn’t covered |

| Misconduct or Dishonesty | If the inability to work stems from illegal or fraudulent activity |

⚠️ Warning: Full Disclosure Matters

Non-disclosure is the #1 reason claims are declined in New Zealand.

Even if something seems minor, such as a past sprain or mild depression, disclose it during the application process.

✅ Always be honest with your medical history — if it’s on the record, you’re more likely to get your payout approved.

🧠 Insight:

Some modern policies in NZ now include partial disability benefits. That means you could still receive a partial monthly payout if you’re only able to work part-time due to recovery limitations.

Factors That Affect Your Premiums in NZ

When it comes to income protection insurance in NZ, not all premiums are created equal. Several factors influence how much you’ll pay each month. Understanding these can help you make smarter, more affordable choices.

Age, Health, Occupation: What Insurers Look At

Here are the main considerations:

● Age: Younger applicants generally pay less.

● Health: Pre-existing conditions can increase your premium or result in exclusions.

● Smoking: Non-smokers almost always pay less.

● Occupational Risk: A desk job is considered a lower risk than scaffolding or deep-sea diving. Higher risk = higher premiums.

● Waiting & Benefit Period: Shorter waiting periods or longer benefit durations cost more.

💡 Tip: Some insurers offer discounted rates if you bundle income protection with life or trauma cover.

How Much Cover Should You Get?

A common guideline in New Zealand is to cover around 75% of your pre-tax income — but that’s just the starting point. The goal is to match your actual monthly living costs.

🧮 Example Breakdown:

● Your Salary: $100,000/year

● 75% Cover = $75,000/year → $6,250/month

● After tax (approx. 20%) → You receive around $5,000/month

This payout should cover your essentials:

✅ Core Expenses to Factor In:

● 🏡 Mortgage or rent

● 💡 Power, internet, water

● 🛒 Groceries

● 🚗 Car loans

● 🛡️ Other insurance premiums

● 🎒 School or childcare fees

💡 Pro Tip:

If you’ve got a healthy emergency fund or generous sick leave, you might choose a slightly lower benefit to save on monthly premiums — just ensure you can still cover the basics.

Use our free tool to estimate your ideal cover level and

compare personalised quotes instantly

Typical Waiting Periods and Benefit Periods

When setting up income protection, two of the most important decisions are:

- How long will you wait before payments begin

- How long will those payments last

🕒 Waiting Period (Before Payout Starts)

| Option | What It Means | Impact on Premium |

| 30 days | Payout starts after 1 month off work | Higher premium |

| 60 days | Payout starts after 2 months | Medium premium |

| 90 days | Payout starts after 3 months | Lowest premium |

💡 Tip: If you have a strong emergency fund or generous employer sick leave, you can choose a longer waiting period to reduce your monthly cost.

📆 Benefit Period (How Long You’ll Get Paid)

| Option | What It Means | Best For |

| 2 years | Payments stop after 24 months | Short-term recovery expectations |

| 5 years | The cover lasts up to 60 months | Mid-range peace of mind |

| Until age 65 | Payments last until retirement if needed | Maximum income security |

💡 Tip: If your family relies heavily on your income, a longer benefit period provides more long-term stability, especially in the event of major health setbacks.

✅ Match your waiting period to your savings buffer.

✅ Match your benefit period to how long you’d need support if you couldn’t return to work

Learn more about How Much Income Protection Cover Do You Really Need?

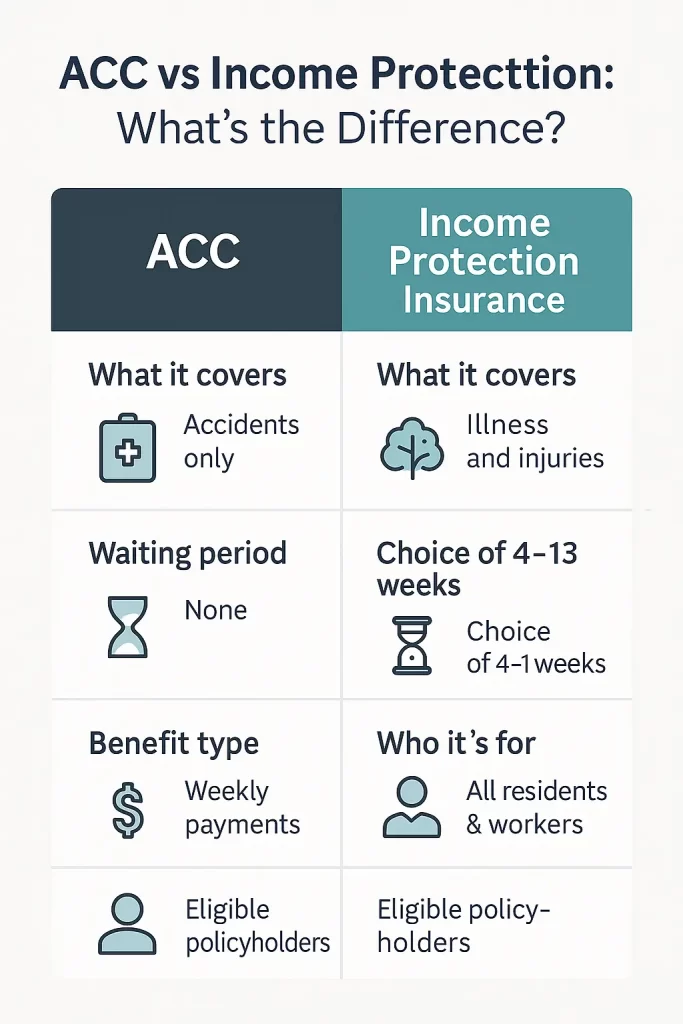

Income Protection vs ACC: Key Differences

📚 Quick Fact:

ACC only covers accidents. Private income protection covers illnesses, injuries, and disabilities, providing financial support in the event of a loss of income due to these events.

| Differences

|

ACC | Private Income Protection |

| What it covers | Accidents only | Illness, accident, injury |

| Maximum payment | Up to 80% of earnings | Up to 75% (with added flexibility) |

| Cost | Paid via levies | Private premium-based |

| Waiting period | Immediate for accidents | Choice of 30-90 days |

✅ Smart Kiwis have both but rely on private cover for most real-world risks.

Common Myths About Income Protection in NZ

| Myth | Reality |

| It’s only for older people | 40% of claims are from people under 45 |

| It’s too expensive | Basic policies start at $25–$30/month |

| My employer provides enough | Group benefits are often limited and taxable |

| ACC will cover everything | ACC excludes most illnesses |

How to Choose the Right Income Protection Policy

Choosing the right income protection plan doesn’t need to be confusing. Just focus on a few key things:

✅ Step 1: Trust the Insurer

● Look for providers rated by A.M. Best or Standard & Poor’s

● Strong financial ratings = more reliable at claim time

✅ Step 2: Compare the Key Features

● Waiting period (30, 60, or 90 days)

● Benefit period (2 years or until age 65)

● Cover amount (how much of your income is replaced?)

💡 Most policies pay up to 75% of your pre-tax income

✅ Step 3: Choose What Works for You

● Agreed value = locked-in payout

● Indemnity value = payout based on income at claim time

● Need redundancy cover too? Ask if it’s an optional add-on.

✅ Step 4: Know the Fine Print

● What’s excluded (e.g., pre-existing conditions)?

● Are payouts taxed?

● Can you increase the cover later without reapplying?

💬 Pro Tip:

Bundle your income protection with mortgage or life insurance — many insurers offer discounts for multi-cover plans.

The best way to know? Compare income protection quotes from top NZ providers based on your job and budget.”

FAQs About Income Protection Insurance NZ

1. Is income protection insurance worth it in New Zealand?

Yes — if you rely on your income to pay the bills, it can be a financial lifesaver if you’re unable to work due to illness or injury.

2. Does income protection cover redundancy in NZ?

Not by default. Redundancy is only covered if you add it as an optional extra (and few insurers offer it in 2025).

3. How much of my salary will income protection replace?

Most NZ policies cover up to 75% of your pre-tax income, paid monthly while you’re off work.

4. Is income protection insurance tax-deductible in New Zealand?

For most individuals, no. But if you’re self-employed or operating as a business, there may be deductions — ask your accountant.

5. How long will income protection pay me for?

That depends on the benefit period you choose — commonly 2 years, 5 years, or until age 65.

Final Thoughts: Protect Your Paycheque Before It’s Too Late

Health issues don’t respect timing.

Neither does financial stress.

✅ Income protection ensures your financial survival through the storm.

If your income is your biggest asset, protect it first.

🛡️ The smart Kiwi move is covering yourself today, not tomorrow.

🛡️ Ready to Protect Your Income?

Don’t leave your finances exposed. Use our free Kiwi-focused tool to compare NZ income protection plans from trusted providers — fast, easy, and obligation-free.

Latest Post

- Income Protection Insurance vs Life Insurance Policy in New Zealand

- Why Are Income Protection Claims Denied? Common Pitfalls Explained

- How to Choose the Best Income Protection Policy in New Zealand

- Income Protection vs Critical Illness Cover: Best Choice for Kiwis

- Income Protection Myths Debunked: What Every Kiwi Needs to Know