Income Protection Insurance vs Life Insurance Policy in New Zealand

TL;DR What they pay and when: A life insurance policy pays a lump sum on death or terminal illness; income protection insurance pays a monthly benefit when you can’t work due to illness or injury. This is the core difference between income…

Why Are Income Protection Claims Denied? Common Pitfalls Explained

When Kiwis claim income protection, most declines can be attributed to a handful of fixable issues—such as missing information, policy exclusions, or timing mistakes. Understanding these patterns now can save you stress later and help you set up coverage that actually pays when you need…

How to Choose the Best Income Protection Policy in New Zealand

Key Takeaways Low Uptake of Income Protection Private income protection coverage in New Zealand is very low, with only 14% of people holding either income or mortgage protection insurance, according to MBIE research on social insurance. ACC Doesn’t Cover Illness ACC provides cover only for…

Income Protection vs Critical Illness Cover: Best Choice for Kiwis

TL;DR Summary Income Protection vs Critical Illness Cover meet different needs: Income Protection replaces income if you can’t work, while Critical Illness provides a tax-free lump sum on diagnosis. Inland Revenue confirms Income Protection premiums can be claimed as a non-business expense if payouts are…

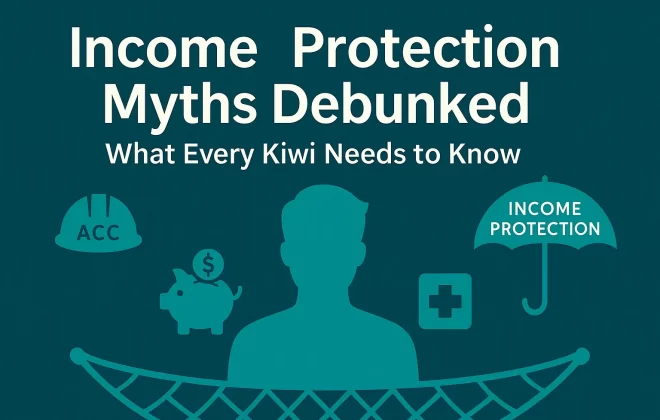

Income Protection Myths Debunked: What Every Kiwi Needs to Know

Income Protection Myths can leave even the most prepared Kiwi dangerously exposed when illness or injury strikes. Income protection insurance replaces up to 75% of your pre-tax earnings if you can’t work—bridging the gaps left by ACC’s accident-only cover, public healthcare’s treatment-only scope and personal…

Income Protection for Young Adults in New Zealand

Income Protection for Young Adults: What It Covers When it comes to Income Protection for Young Adults, your ability to earn a wage is your single most important asset. After all, over a 40-year career, the average Kiwi could earn around $2 million. But what…

Key Person Insurance in New Zealand: Essential 2025 Guide

Imagine you run a small business here in New Zealand — perhaps you’re a sole trader, or you have a handful of employees. Your business success depends heavily on you and maybe a few key people who bring skills, clients, or leadership to the table….

Income Protection vs Trauma Insurance: 2025 Comparison Guide

In New Zealand, ACC covers accidents but leaves a significant gap when it comes to serious illnesses and disabilities related to sickness. That’s why comparing income protection vs trauma insurance is so important—each policy fills a different financial need when you can’t work or face…

Redundancy Insurance NZ vs Income Protection Insurance – Expert Tips

Understanding redundancy insurance NZ vs income protection insurance is crucial for New Zealand workers facing both job loss and health-related income risks. With redundancy rates rising in specific industries and ACC covering most work-related injuries, choosing the right cover ensures financial resilience. This article compares…